Saudi Ceasefire Negotiations, Rising Oil Prices, and Non-Ferrous Metals Market Analysis

Today, we will conduct an in-depth analysis of the ongoing ceasefire negotiations in Saudi Arabia, the resulting surge in oil prices, the non-ferrous metals market, and the KOSPI. This article covers several crucial issues, so stay focused until the end.

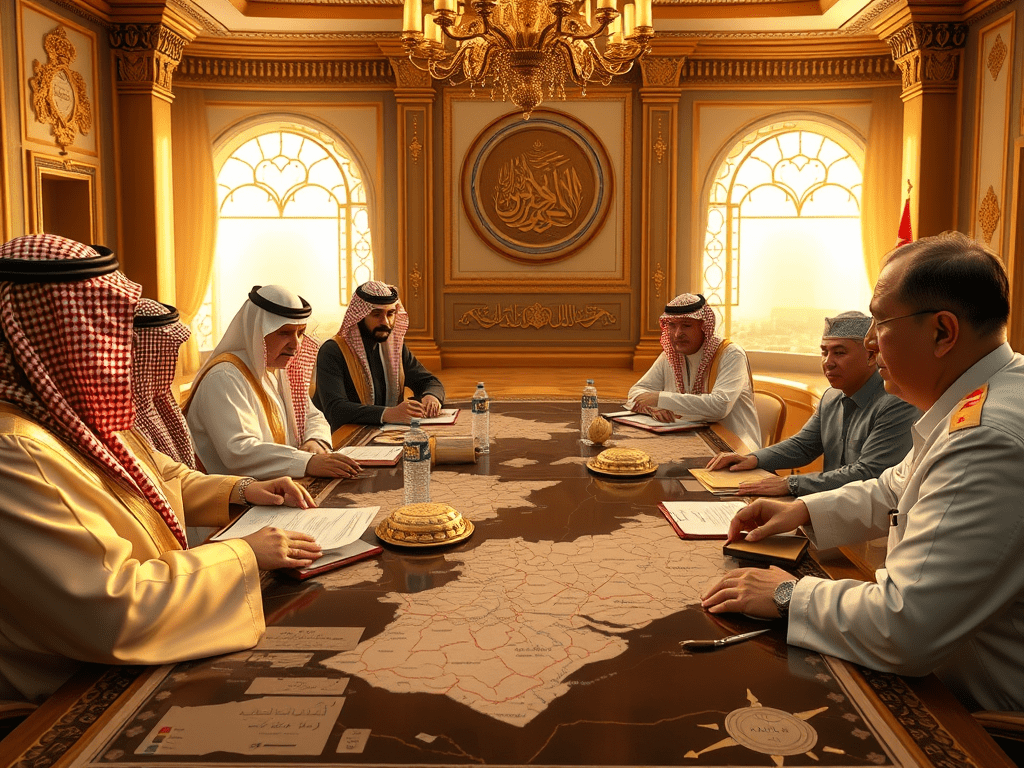

Significance of Saudi Ceasefire Negotiations

The negotiations taking place in Saudi Arabia are more than just a diplomatic event. Given the significant benefits for multiple nations, this presents an opportunity for Saudi Arabia to strengthen its global standing. Through these talks, Saudi Arabia can elevate its reputation as an international mediator and enhance its leadership role within OPEC, further solidifying its influence over oil prices.

Additionally, the ceasefire negotiations are expected to strengthen Saudi Arabia’s defense cooperation with the U.S., which could be instrumental in exerting pressure on Iran.

Russia’s Position and Economic Impact

This ceasefire agreement could also be beneficial for Russia. If economic sanctions are eased, Russia’s energy and non-ferrous metals exports could see significant growth, positively impacting the country’s finances. Currently, Russia relies heavily on China due to Western sanctions, but these negotiations could create opportunities for Russia to expand partnerships with Europe and the United States.

Such changes would also be advantageous for the U.S., as they could reduce financial losses related to Ukraine and further strengthen America’s standing in Europe and NATO.

China’s Rare Earth Strategy

China is strategically timing its leverage over rare earth elements. In response, the U.S. is securing rare earth mining rights in Greenland and Ukraine to reduce its dependence on China. This strategic move is aimed at curbing China’s dominance over the rare earth supply chain.

Given that all three major players—Saudi Arabia, Russia, and China—stand to benefit from these negotiations, there is a high probability of a successful ceasefire agreement.

Ukraine’s Role and Resistance

However, Ukraine is unlikely to welcome these negotiations. President Zelensky has been excluded from the talks, leading to retaliatory actions, such as attacks on oil pipeline facilities. This situation is largely a consequence of Ukraine’s own strategic decisions rather than direct actions from the U.S. or European nations.

Relationship Between Oil Prices and the Non-Ferrous Metals Market

If Saudi Arabia successfully facilitates the ceasefire, energy prices should ideally decrease. However, oil prices are currently rising due to two key factors: Ukraine’s attacks on oil pipelines and market expectations for China’s upcoming economic stimulus measures.

A large-scale stimulus package from China would increase overall energy consumption, contributing to sustained high oil prices.

Interest Rate Outlook

Concerns over interest rate hikes are growing. While some experts predict rate increases, the probability of rates remaining unchanged is currently high. To gain a clearer understanding, it is essential to analyze the bond market.

Long-term interest rates should be higher than short-term rates, and current data suggests a more stable outlook rather than a sharp increase. It is crucial not to be misled by misleading analyses from unqualified experts.

Importance of the Non-Ferrous Metals Market

The non-ferrous metals market is a critical indicator of the economy’s future trajectory. Significant price fluctuations in non-ferrous metals can signal economic downturns or expansions. Currently, the market is highly sensitive to changes in supply and demand.

If Russia reaches a favorable agreement in the ceasefire talks, non-ferrous metal prices may decline, impacting related industries and stock prices.

Conclusion

The various issues discussed today are deeply interconnected. A successful ceasefire agreement in Saudi Arabia will have far-reaching effects on oil prices and the non-ferrous metals market. Since all major nations involved have vested interests in ensuring a successful outcome, the likelihood of a favorable resolution is high.

Understanding market conditions and analyzing volatility will be crucial for making informed investment decisions. We hope that the insights provided in this article will help guide your investment strategies. Thank you for reading!