Investing in the stock market requires more than just following news trends and market speculation. Talk Stock Make Easy (딱주부TV) is a YouTube channel dedicated to helping investors make informed, logical, and strategic decisions through in-depth financial analysis. Whether you’re a beginner or an experienced trader, this channel offers valuable insights to enhance your investment journey.

Let’s explore what makes Talk Stock Make Easy a standout resource for smart investing.

1. A Data-Driven Approach to Stock Market Analysis

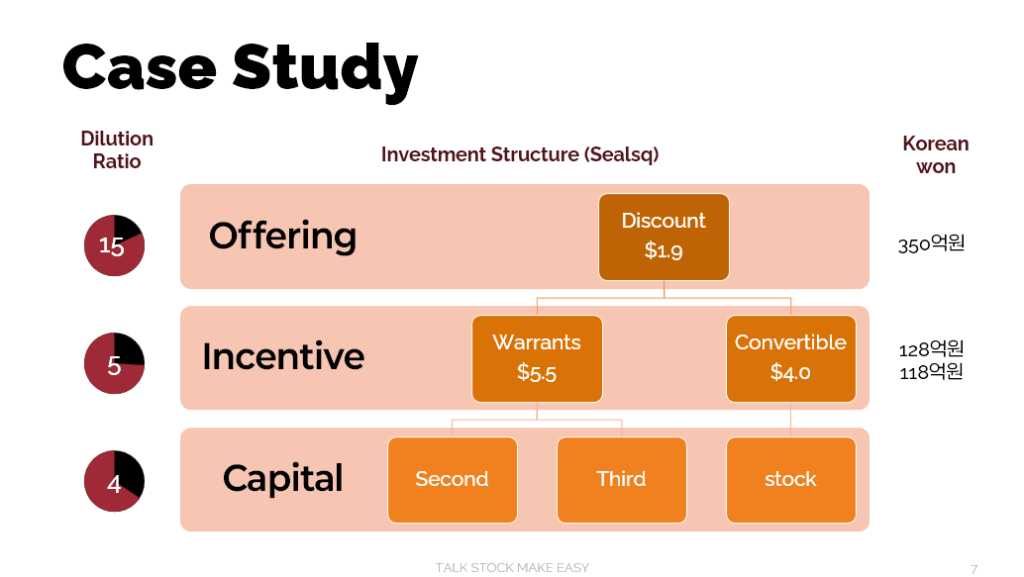

Unlike many investment channels that focus on hype-driven stocks or vague predictions, Talk Stock Make Easy utilizes a multifaceted analytical approach that combines quantitative financial metrics with qualitative market insights.

- Quantitative Analysis: In-depth evaluation of key indicators like ROE, PBR, cash flow, and earnings growth.

- Qualitative Analysis: Assessing management decisions, industry trends, competitive positioning, and risk factors.

This structured approach ensures that investment decisions are based on real data rather than speculation.

2. Personalized Investment Strategies for Every Type of Investor

One of the biggest strengths of this channel is its customized approach to investment strategies. Whether you are a short-term trader or a long-term investor, the channel provides tailored insights to help you make smarter decisions.

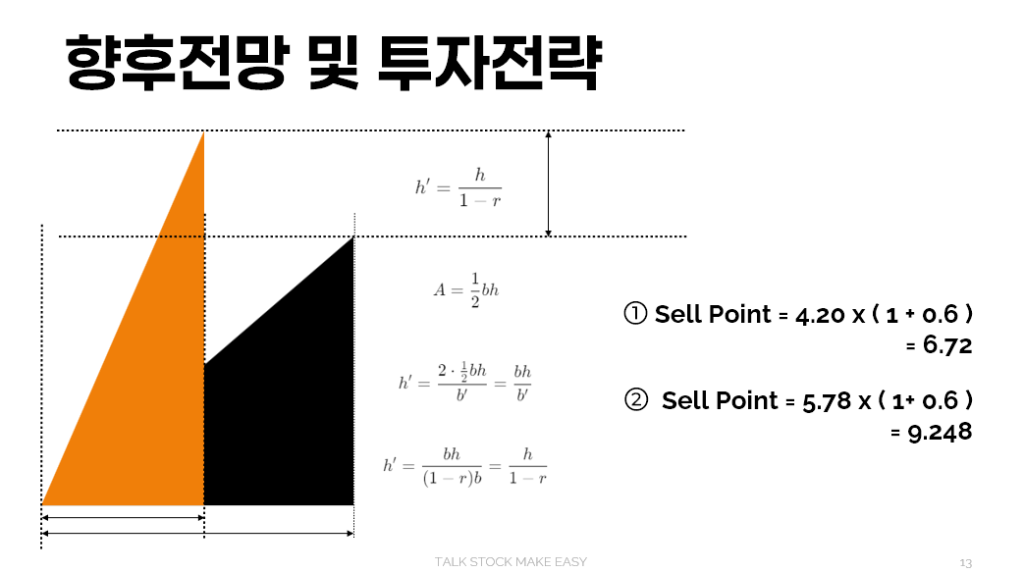

- Short-Term Traders: Learn how to analyze technical indicators and spot entry/exit points efficiently.

- Long-Term Investors: Get fundamental analysis on undervalued stocks with strong growth potential.

- Risk Management: Strategies to avoid common pitfalls and make data-backed decisions.

Rather than focusing on short-lived stock trends, the channel encourages sustainable investment strategies that yield long-term success.

3. In-Depth Fundamental Analysis for Smarter Stock Picks

Fundamental analysis is at the core of Talk Stock Make Easy. The channel provides comprehensive breakdowns of company financials, including:

- Detailed financial statement analysis to understand a company’s real value.

- IPO, R&D investment, and M&A activity insights to gauge growth potential.

- Review of financial statement footnotes to uncover hidden risks or opportunities.

This level of deep research ensures that investors are not misled by surface-level financial data.

4. Staying Ahead with Market Trends & Macroeconomic Analysis

The stock market is influenced by economic trends, interest rates, inflation, and geopolitical risks. This channel keeps investors informed by:

- Analyzing global economic shifts and their impact on various industries.

- Highlighting investment opportunities before they gain mainstream attention.

- Providing insights on inflation, central bank policies, and foreign exchange movements.

By understanding the broader financial landscape, investors can make better long-term decisions.

5. Simplified Yet Expert-Level Explanations

A common challenge with financial education is the complexity of technical terms. Talk Stock Make Easy bridges this gap by breaking down complex concepts into easy-to-understand explanations.

- Uses real-world examples and practical analogies to explain financial principles.

- Simplifies technical jargon so that both beginners and seasoned investors can understand.

- Maintains an engaging and approachable tone to make learning about finance enjoyable.

This is why the channel’s slogan, “Making stock investing easy”, perfectly reflects its mission.

6. Live YouTube Sessions for Real-Time Market Insights

The channel hosts live sessions every night at 9 PM (KST), allowing viewers to engage in real-time discussions about the market.

- Interactive Q&A format where viewers can get personalized investment advice.

- Instant updates on breaking financial news and how they impact stock movements.

- Live stock analysis sessions to evaluate market trends in real time.

These live sessions are a great way to stay updated and learn investment strategies directly from an expert.

7. Investor Psychology & Risk Management

Investing isn’t just about numbers—it’s also about mindset and emotional control. Talk Stock Make Easy teaches investors how to:

- Avoid emotional decision-making, like panic selling or FOMO (Fear of Missing Out).

- Manage risk effectively by implementing stop-loss strategies and portfolio diversification.

- Develop the discipline needed for long-term success in stock investing.

By strengthening investment psychology, traders can make more rational, calculated decisions.

8. Objective & Data-Backed Stock Recommendations

The channel does not promote hyped-up stocks or speculative trading. Instead, it focuses on value investing and fundamentally strong stocks.

- Avoids “hot stocks” or meme stocks that are driven by market frenzy rather than fundamentals.

- Emphasizes valuation metrics to determine whether a stock is fairly priced.

- Encourages patience and disciplined investing rather than chasing quick gains.

The philosophy here is simple: “Even a great stock can be a bad investment if bought at the wrong price.”

9. Combining Technical & Fundamental Analysis for Better Results

Most investors rely solely on technical indicators or fundamental analysis, but this channel teaches how to integrate both.

- Technical Analysis (TA): Chart patterns, moving averages, RSI, MACD, and support/resistance levels.

- Fundamental Analysis (FA): Earnings reports, financial health, and competitive positioning.

- Entry/Exit Strategies: Understanding when to buy and sell based on both approaches.

This combination provides a well-rounded investment strategy for maximizing returns.

10. A Long-Term Investment Education Hub

Rather than just offering stock picks, the channel focuses on educating investors to build long-term skills.

- Learn how to analyze financial reports, understand market cycles, and interpret economic data.

- Develop critical thinking skills to make informed financial decisions.

- Transition from passive investor to an active, knowledgeable participant in the stock market.

By following this channel, you’ll gain the tools and knowledge necessary for consistent investment success.

Final Thoughts: Why You Should Subscribe to Talk Stock Make Easy

If you are serious about learning investment strategies, analyzing financial data, and making smarter decisions, Talk Stock Make Easy (딱주부TV) is one of the best educational resources available.

Unlike many other financial YouTube channels, this one focuses on practical education, real data analysis, and sustainable investment strategies.

📌 Key Takeaway:

📍 “Make stock investing easy with data-driven strategies and logical analysis.”

🔗 Subscribe now and start learning from an expert today:

👉 Talk Stock Make Easy (딱주부TV) YouTube Channel