Introduction: Understanding the Geopolitical Tensions & Market Implications

As Iran advances its nuclear program, global financial markets are facing heightened volatility. Investors and policymakers must carefully assess the economic and political consequences, as these developments have far-reaching effects on oil prices, stock markets, and international trade.

In this analysis, we explore Iran’s nuclear ambitions, the U.S. response, and their implications for financial markets. We’ll also outline actionable investment strategies to mitigate risks and capitalize on potential opportunities.

Iran’s Nuclear Program: What’s at Stake?

Iran’s official acknowledgment of its nuclear capabilities could trigger severe geopolitical consequences. The global community is closely monitoring whether this escalation will lead to renewed sanctions, diplomatic negotiations, or military interventions.

Potential Geopolitical Fallout

- Sanctions & Economic Pressure: The U.S. and its allies could impose additional financial restrictions, impacting Iran’s economy and global energy markets.

- Military Confrontation Risks: Escalations could lead to military strikes, disrupting oil supply routes and affecting market stability.

- Regional Power Shifts: Iran’s growing influence in the Middle East could pressure neighboring nations to reassess their defense policies.

Understanding these factors is crucial for anticipating market reactions and making informed investment decisions.

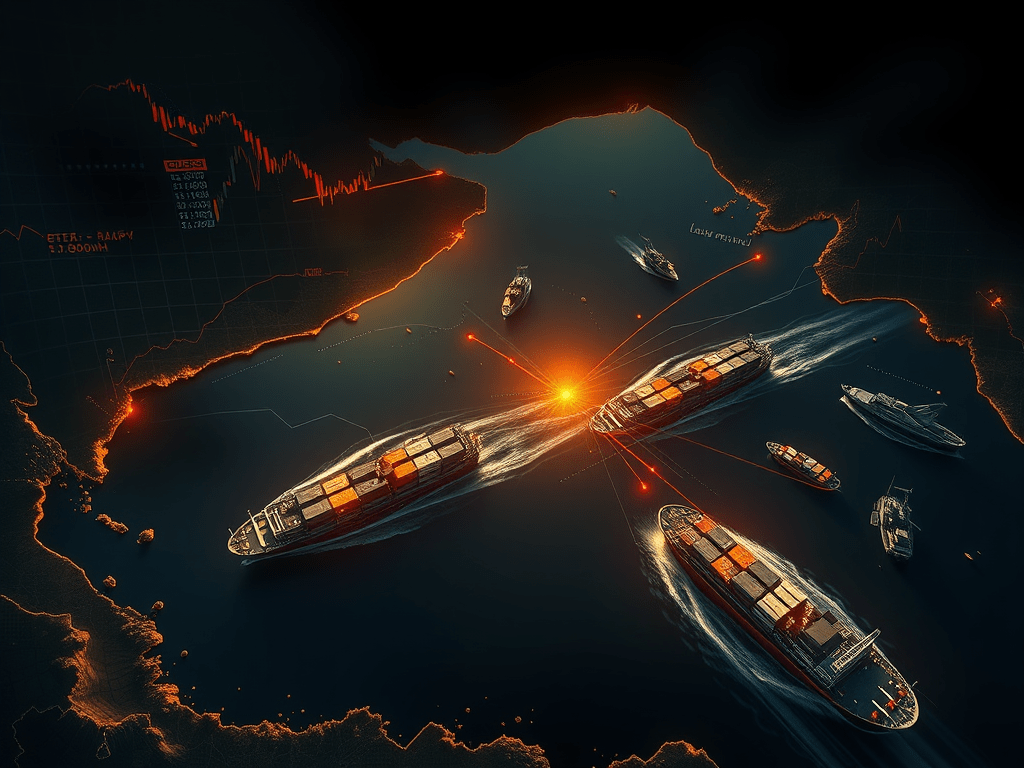

The Hormuz Strait: A Global Energy Bottleneck

The Strait of Hormuz is one of the world’s most critical maritime chokepoints, handling nearly 30% of global oil shipments. Any disruptions in this region could send oil prices soaring, creating ripple effects across financial markets.

Market Reactions to Potential Disruptions:

- Oil Prices Surge: Even minor conflicts in the region could push oil prices above $100 per barrel.

- Stock Market Volatility: Energy-dependent sectors may experience sharp declines, while commodity-based stocks may gain.

- Currency Fluctuations: The U.S. dollar and safe-haven currencies like the Swiss franc and Japanese yen may strengthen as investors seek stability.

For investors, monitoring developments in the Strait of Hormuz is essential for managing portfolio risks.

Historical Perspective: U.S.-Iran Relations & Financial Sanctions

The strained relationship between the U.S. and Iran dates back decades, influencing global markets repeatedly. Key historical events include:

- 1951: Iran’s oil nationalization and subsequent U.S. intervention.

- 1979: The Islamic Revolution and the Iran Hostage Crisis.

- 2015: The Iran Nuclear Deal (JCPOA) aimed at limiting nuclear activities.

- 2018: The U.S. withdrawal from the JCPOA, reinstating sanctions.

Each of these events led to significant shifts in oil prices, stock market reactions, and global investment strategies.

Effectiveness of Financial Sanctions

Financial sanctions have been a primary tool to curb Iran’s nuclear program, but their success is mixed. Iran has adapted by:

- Strengthening trade ties with non-Western countries (China, Russia, India).

- Utilizing cryptocurrencies for international transactions.

- Developing alternative financial channels to bypass banking restrictions.

These workarounds highlight the limitations of sanctions and the need for investors to consider alternative risk mitigation strategies.

Financial Market Impacts of Escalating Tensions

Scenario 1: Diplomatic Resolution

- Market Impact: Stabilization in oil prices, recovery in global stock markets.

- Investment Strategy: Focus on emerging markets and growth stocks.

Scenario 2: Limited Military Conflict

- Market Impact: Temporary spikes in oil prices, short-term stock market volatility.

- Investment Strategy: Increase holdings in energy ETFs and defensive sectors.

Scenario 3: Full-Scale War

- Market Impact: Oil prices exceed $120 per barrel, severe stock market declines, recession risks.

- Investment Strategy: Allocate funds to gold, U.S. Treasuries, and defensive stocks.

Understanding these scenarios allows investors to proactively adjust their portfolios based on risk tolerance and geopolitical developments.

Investment Strategies for Navigating Uncertainty

1. Invest in Defensive Sectors

- Healthcare, utilities, and consumer staples tend to outperform during geopolitical crises.

- Examples: Johnson & Johnson (JNJ), Procter & Gamble (PG), and Duke Energy (DUK).

2. Hedge with Commodities

- Gold & Oil ETFs act as safe-haven assets during uncertainty.

- Consider funds like SPDR Gold Trust (GLD) and United States Oil Fund (USO).

3. Diversify with ETFs

- ETFs provide broad exposure to energy, commodities, and international markets.

- Recommended: iShares MSCI Emerging Markets ETF (EEM) and Energy Select Sector SPDR (XLE).

4. Monitor Safe-Haven Currencies

- The Swiss franc (CHF) and Japanese yen (JPY) often appreciate during crises.

- Forex traders can hedge risks by holding currency pairs like USD/CHF and USD/JPY.

Conclusion: Staying Ahead of Geopolitical Risks

Iran’s nuclear developments and escalating tensions with the U.S. will continue to shape global financial markets. Investors must remain vigilant, adapting strategies to mitigate risks and seize potential opportunities.

Key Takeaways:

✔ Stay informed on geopolitical developments and economic sanctions. ✔ Diversify investments with defensive sectors, commodities, and ETFs. ✔ Prepare for volatility by monitoring oil prices and safe-haven assets. ✔ Act proactively, adjusting strategies based on market scenarios.

By leveraging strategic insights and financial market analysis, investors can navigate these turbulent times with confidence and resilience.

Follow Us for More Market Insights!

📢 Stay updated with the latest financial market trends by subscribing to our blog!