In this blog, we delve into the ramifications of recent financial market analysis surrounding Trump’s tariffs on Mexico and Canada, and how these geopolitical tensions may influence global markets. The discussion also extends to China’s potential responses and the implications for investors amidst these turbulent times.

Introduction to the Current Market Situation

The current market situation is marked by heightened tensions due to recent tariff implementations. These tariffs have created ripples across the financial landscape, affecting not only the countries directly involved but also global economic stability. Investors are now navigating a complex web of reactions, policy changes, and market fluctuations.

The swift responses from Mexico and Canada to the tariffs have sent a strong signal to the markets. Both nations have announced compliance with U.S. demands, altering their trade practices and policies in response to the pressure exerted by the tariffs. This compliance is expected to have immediate and far-reaching implications for financial market analysis.

Trump’s Tariff Impact on Mexico and Canada

Trump’s tariffs have been described as a nuclear bomb dropped on the economic landscape of North America. The rapid capitulation of Mexico and Canada showcases the impact of these tariffs on their economies. Mexico’s agreement to enforce stricter immigration controls and cooperate with U.S. policies demonstrates a significant shift in its trade approach.

Canada’s response, which includes a substantial financial commitment to border security and drug control, indicates a serious commitment to align with U.S. demands. This collaboration is likely to impact bilateral trade relationships and economic forecasts for both nations.

Market Reactions and Economic Indicators

The immediate market reactions to the announcements from Mexico and Canada were significant. Following the compliance declarations, the U.S. stock market saw a notable drop, reflecting investor anxiety over the implications of the tariffs. However, the market also experienced a surprising rebound, attributed to positive economic indicators that emerged simultaneously.

This duality in market behavior underscores the complex interplay between geopolitical events and economic data. While tariffs have the potential to disrupt markets, favorable economic conditions can provide a counterbalance, leading to unpredictable market movements.

- Stock Market Volatility: The volatility in stock prices reflects investor uncertainty and the rapid changes in market sentiment.

- Economic Indicators: Positive economic data can lead to temporary market recoveries, even amidst negative geopolitical news.

- Long-term Outlook: Investors must consider the long-term effects of tariffs on trade relations and economic health.

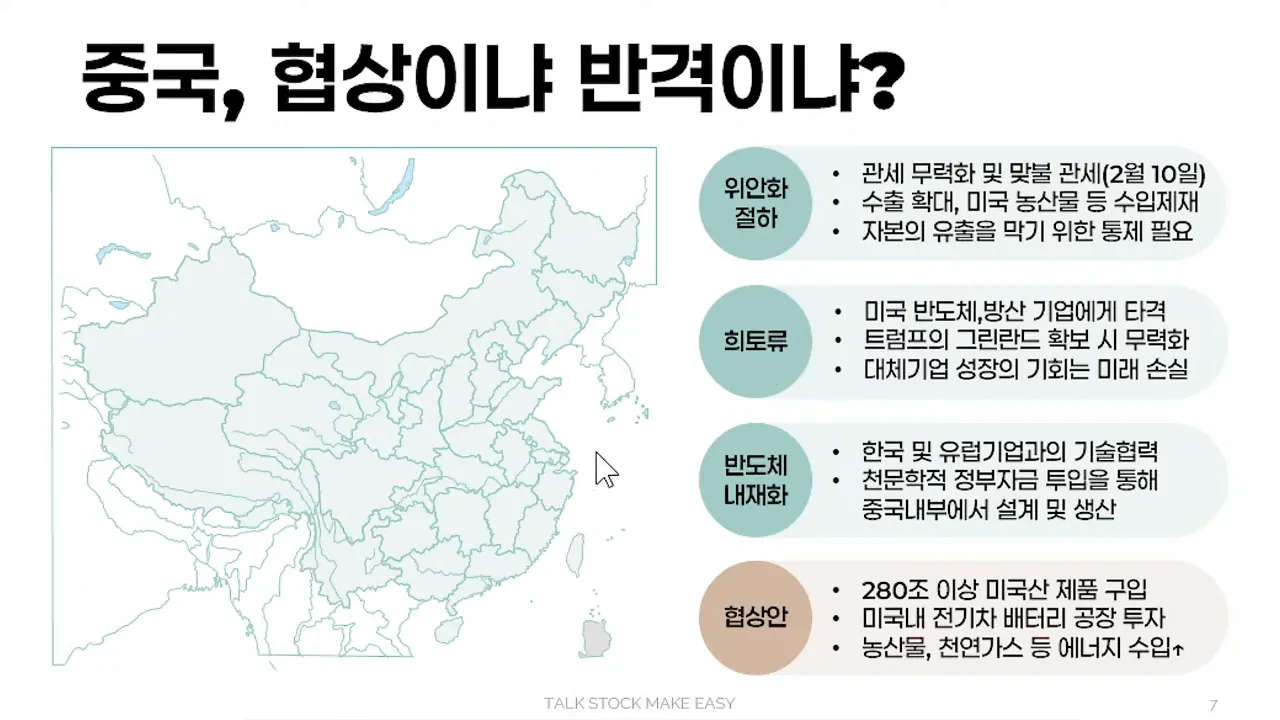

China’s Strategic Position and Potential Responses

China’s strategic position in the wake of tariffs is critical. Unlike Mexico and Canada, which quickly capitulated, China is expected to adopt a more combative stance. The potential for negotiations exists, but the likelihood of compliance is low.

China is likely to respond to tariffs with a range of strategies, including currency devaluation and increased exports. These actions aim to mitigate the economic impact of U.S. tariffs while maintaining competitive pricing for its goods in the global market.

- Currency Devaluation: A devaluation of the yuan could counteract the effects of tariffs by making Chinese goods cheaper in foreign markets.

- Increased Exports: China may seek to expand its exports to other markets, offsetting potential losses in the U.S.

- Strategic Alliances: Collaborating with other countries to counterbalance U.S. influence could become a key strategy for China.

The Role of Rare Earth Elements in Geopolitical Strategy

Rare earth elements (REEs) play a crucial role in the global economy, particularly in technology and defense sectors. These elements are essential for manufacturing electronics, batteries, and advanced materials. As countries vie for technological supremacy, the control of REEs has become a focal point in geopolitical strategies.

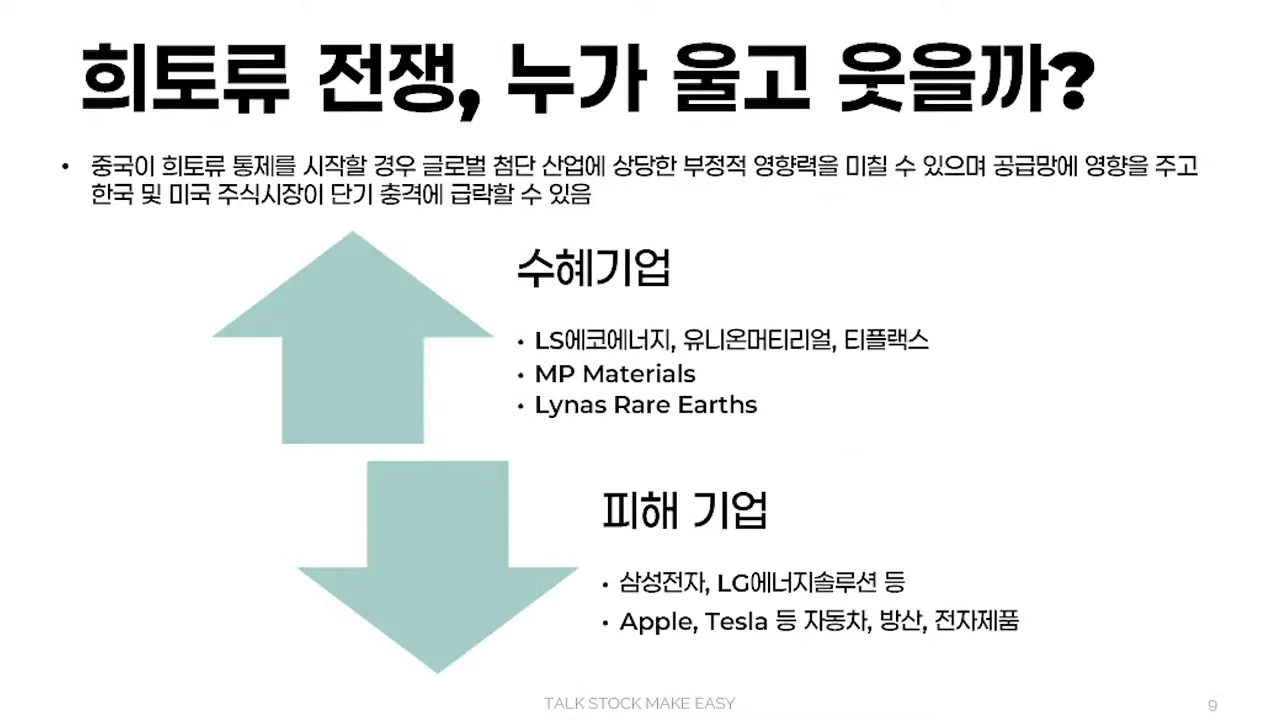

China currently dominates the rare earth supply chain, producing over 80% of the world’s REEs. This dominance gives China significant leverage over global industries reliant on these materials. If China were to impose restrictions on REE exports, it could lead to substantial disruptions in various sectors, including electronics and renewable energy.

Implications for Global Markets

The immediate impact of China’s control over REEs would likely result in a sharp decline in stock markets worldwide. Companies that depend heavily on these materials, such as electronics manufacturers and automotive producers, would face significant challenges. The initial shock may lead to a temporary market downturn, but recovery could follow as alternative supply chains are developed.

- Market Volatility: The uncertainty surrounding REE supply could cause fluctuations in market prices, affecting investor confidence.

- Opportunities for Alternative Suppliers: Companies researching substitutes for REEs, such as Eco Energy and Union Material, may see increased interest from investors as they seek to mitigate risks associated with reliance on China.

- Defensive Strategies: Firms may need to rethink their supply chain strategies to avoid over-dependence on any single country, prompting a broader search for diverse sources of REEs.

Challenges of Semiconductor Self-Sufficiency in China

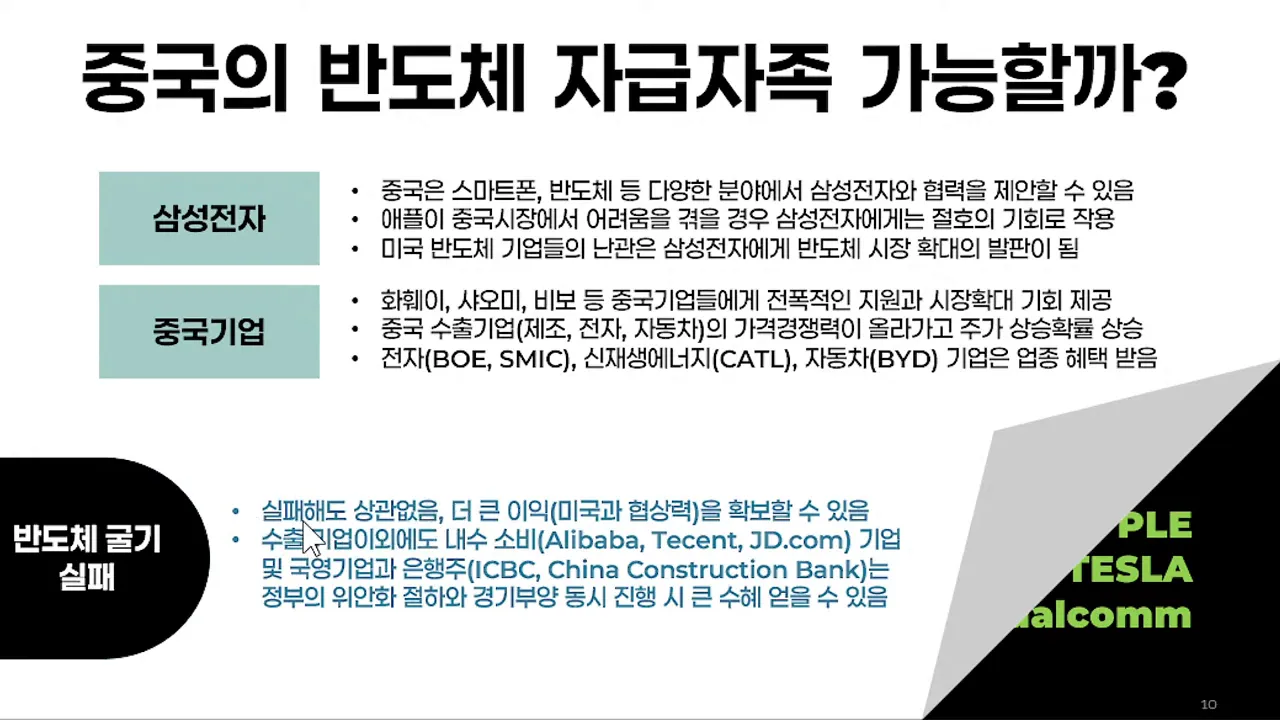

As the semiconductor race intensifies, China’s ambition to achieve self-sufficiency in this critical sector faces numerous obstacles. Despite substantial investment, China remains heavily reliant on foreign technology and components, particularly from the United States.

The U.S. has implemented stringent export controls on advanced semiconductor technologies, making it increasingly difficult for Chinese companies to acquire the necessary tools to compete globally. This situation has created a paradox where, despite significant financial backing, China’s semiconductor industry struggles to break free from foreign dependency.

Impact on Major Companies

Major Chinese tech companies, such as Huawei and Xiaomi, are under pressure as they navigate these restrictions. While they continue to innovate, the lack of access to cutting-edge technology hampers their growth potential. The situation creates a mixed landscape where some companies may find opportunities, while others may falter.

- Potential Winners: Companies like Samsung could benefit from China’s challenges, gaining market share in sectors where Chinese firms are restricted.

- Strategic Adaptations: Chinese firms may pivot to focus on less advanced technologies or seek partnerships with countries less influenced by U.S. sanctions.

- Long-term Outlook: The quest for semiconductor independence will likely continue, but it may take years for China to fully realize its goals.

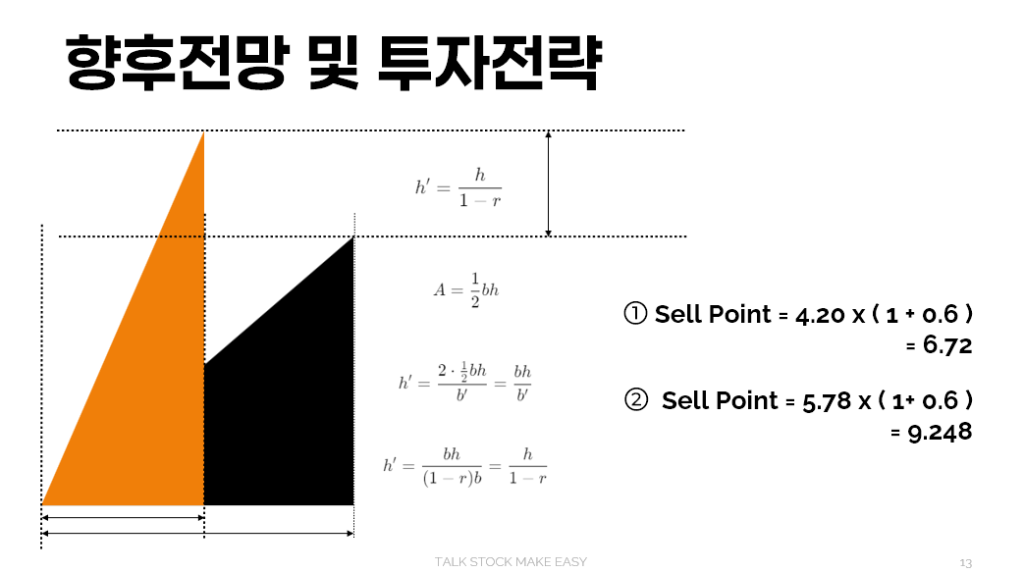

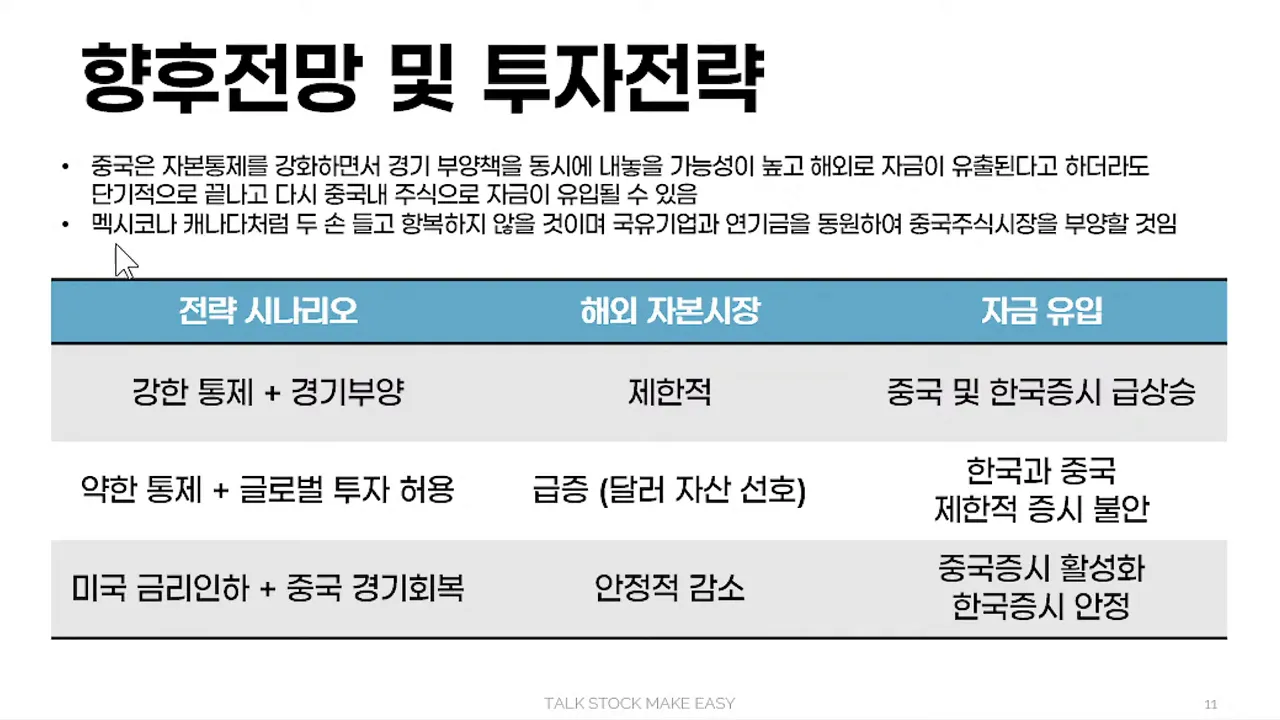

Future Outlook and Investment Strategies

The geopolitical landscape surrounding rare earth elements and semiconductors is shifting rapidly. Investors should remain vigilant and consider various strategies to navigate this complexity. Understanding which sectors may benefit or suffer is crucial for informed decision-making.

As the situation evolves, several investment strategies may emerge:

- Diversification: Investors should look to diversify their portfolios to mitigate risks associated with geopolitical tensions. This includes exploring companies involved in alternative technologies.

- Monitoring Market Trends: Keeping an eye on market indicators and economic data can help investors anticipate shifts in market sentiment.

- Focusing on Innovation: Investing in companies that prioritize research and development in REE alternatives and semiconductor technologies may yield long-term benefits.

In conclusion, the interplay between rare earth elements, semiconductors, and geopolitical strategies will continue to shape the financial landscape. Investors who stay informed and adapt their strategies accordingly will be better positioned to capitalize on emerging opportunities and mitigate potential risks.